Does your house have a Tax Lien? Find out below how to to resolve the lien or how to Sell your House with a Tax Lien.

As the year is coming to an end, many people have either spent a large part of their savings on loved one’s gifts, festivities and that perfect outfit for a New Years party. Isn’t that what life is about; family, friends and a good time? Unfortunately, it is also time for paying taxes. A quote from a very popular book comes to mind “Render therefore unto Caesar the things which are Caesar’s”.

When are Taxes Due

In Greenville county, SC “All taxes are due and payable between the 13th day of September and the 15th day of January after their assessment in each year. When taxes are not paid before the 16th day of January, a three percent penalty is added to the amount due.” Interest grows from 3% to 12% jumping up a percent each month delinquent, in three month increments. If taxes have not been paid on time by the home owner, interest, fees and taxes will start to grow.

Notices of Delinquent Taxes

Following the delinquent taxes, taxpayer will begin receiving multiple notices mailed to the property. To get the exact order and procedure follow this link. The procedure may differ state to state. For most accurate information visit your local tax office.

Now, this is not a good way to start a New Year. However, “Once the property is sold for delinquent taxes, a redemption period begins for 1-year Taxpayer may “redeem” property by paying the delinquent tax amount plus the applicable interest rate.” for detailed information follow link.

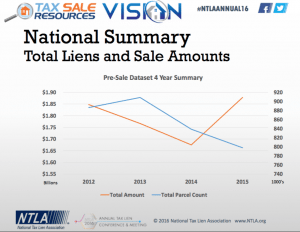

Graph of Total Liens and Sale Amounts

According to National Tax Lien Accusation, in 2015 a total of about 1.87 Billion dollars was owed for taxes. So don’t feel alone if you have delinquent taxes or a tax lien on your house. What is a tax lien? “A tax lien is a lien imposed by law upon a property to secure the payment of taxes. A tax lien may be imposed for delinquent taxes owed on real property or personal property, or as a result of failure to pay income taxes or other taxes.”

How serious is owning Tax Liens?

According to US.News “The IRS, for all the fear it instills in taxpayers, is well known for working with those who owe a lot of back taxes. If you also owe taxes to a smaller government entity, such as your state or municipality, it can be an even bigger problem. In some states, as crazy as it sounds, people have lost homes for owing just a few hundred dollars in back county and city taxes. As a general rule, you should worry about paying back the smaller government debts first.”

According to a 2010 Congressional testimony by Nina Olson, who leads the Taxpayer Advocate Service, an independent organization within the IRS.”Your credit score will likely take a hit, possibly dropping as much as 100 points”. Your credit score taking such a hit would be devastating, but that would not be the worst thing. “It is extremely serious. You could lose your property,” says Rafael Castellanos, managing partner at Expert Title Insurance Agency LLC in New York City.”

How to solve your issue

If you don’t know for sure, visit your local tax collector or court house to find out if you have a tax lien. You may be able to arrange a payment method or at least show them that you are willing to work with them. However, if you are out of options and not willing to jump through all the hoops, or if you have been wondering “can i sell my house with a tax lien?” The answer is yes. When a house sells, you will have to pay the taxes that are owed, but the amount owes simply comes out of the money you are receiving for the house. In most cases, you can still walk away with a substantial amount of cash in your pocket. Find a local Cash buyer and speak with them to find out how to sell a house fast. A tax lien on your property is a serious matter, don’t wait, look for a solution now.